The Round Up: September 27th

China shakes the Crypto market, behemoth NFT fundraisers and Twitter's Creator Economy

This is a newsletter about crypto markets, highlighting interesting developments across the ecosystem. To receive this newsletter in your inbox, subscribe here:

Pick #1: Drama in China hits global crypto markets

On Friday, The People's Bank of China announced that cryptocurrency transactions would be classified as illegal, indicating that crypto did not have “legal tender status” and was contributing to “criminal activities in the country,

It’s been a rough week for global crypto markets off the back of the Evergrande issues. With this announcement from the Chinese Central Bank, the tokens for huobi token (HT) and OKEx's OKB token (OKB) both plunged by over 15%.

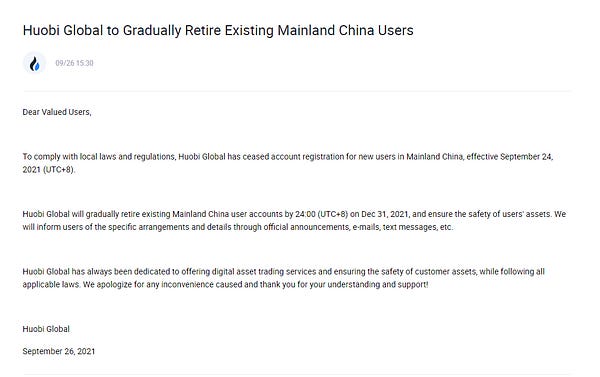

This morning Huobi announced that they would de-active all existing users from Mainland China.

My Take: It’s been a rough week across the crypto markets; the issues with Evergrande and Chinese regulation have accelerated calls of a market top from crypto bears.

I don’t like calling the market, but both of these issues are catalysts for defi. Over-regulation will be a defi catalyst, fiscal irresponsibility from govt/companies will be a defi catalyst… these issues remind us of why leveraging software to create permissionless/trustless systems matter.

Oh, did I also mention that Coinbase withdrew their lend product as well this week? Rough times, Mr Armstrong.

Pick #2: August, a great month for NFT fundraising

Last week Sorare, a fantasy soccer NFT platform, raised a massive $680mm round led by Softbank Vision Fund 2, valuing the business at $4.3bn. Not to be outdone, Dapper Labs also raised $250mm at a $7.6bn valuation, led by Coatue Management.

Both announcements come off massive activity in August, with $2.1bn in venture funding across the crypto market.

Opensea had a great month in August, source: Dune Analytics My Take: For all the FUD in the last two weeks, these fundraise announcements remind us the rapid evolution of the market. Many of you have asked me my thoughts on 2018, and my mental model is simple: this is not the same.

In 2018, the lack of capital meant that many teams shutdown, investor appetite dried up, which across the board, choked market activity. The amount of institutional investors who have raised $bns for crypto funds are just coming live… this will be deployed in the next 12-18 mos.

Pick #3: Twitter’s Creator Economy

Last week, Twitter enabled bitcoin tipping for iOS users today as part of its “turning fans into funds” strategy, integrating BTC payments via the Lightning network.

Source: Twitter

Further, Twitter also plans to roll out an NFT authentication feature, allowing the holders of NFTs to be verified owners on Twitter (take that, Jpeg copy+pasters!)

My Take: Twitter’s strategy looks to be reflective of a broader mandate from Dorsey to use his two key properties - Twitter / SQ - to lead the way for main-stream use-cases for crypto. Twitter’s specific focus on a “creator’s hub” makes alot of sense, and hopefully, finally introduces monetization that the TWTR leadership team have been trying to find for 8+ years.

Sidenote: Who wants to take bets with me on when TWTR & SQ merge?

Thanks for following 💕

I hope you enjoyed this round-up, feel free to connect with me by replying directly to this thread, follow me on twitter @infinityhai.

Disclaimer: Don’t take this newsletter as investment advice, all of this content reflects my opinions and ideas on where the world is going. As always, DYOR and stay safe - it’s the wild west out here.